Your new banking experience is here

Log in to the new Personal Online Banking with your existing credentials

Check out the new experience!

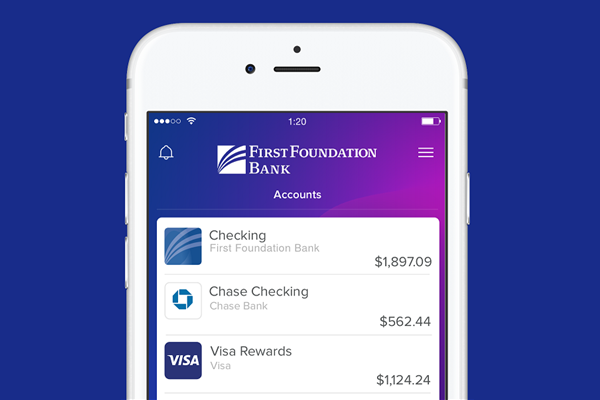

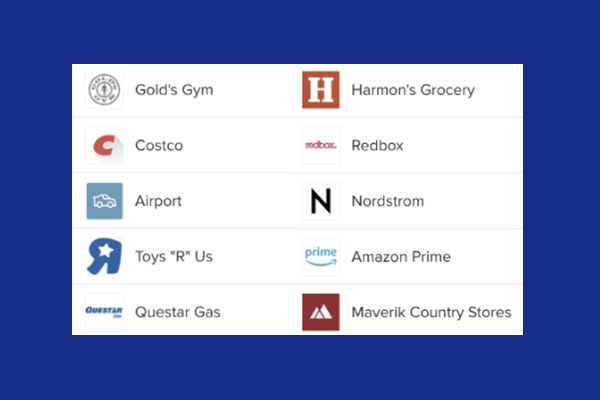

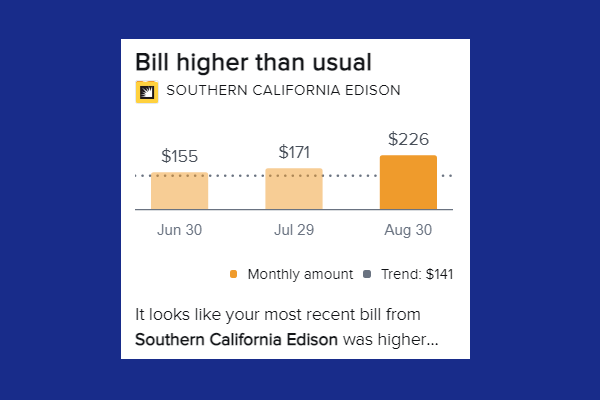

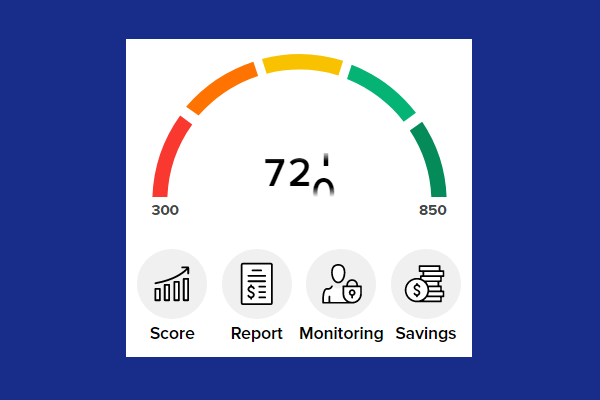

We have thoughtfully redesigned our online and mobile banking experiences to bring you an entirely new perspective on financial management and wellness. All of the personal online banking features that you are used to with First Foundation today have been enhanced, but we have also added countless new conveniences such as: automated money management tools, visibility across all of your financial institutions, personalized insights and spending trends, built-in card controls, expanded history and statement availability, native bank support, and much more.

With our new digital banking experience, you will be able to see a holistic view of your finances and effortlessly monitor and conduct your personal banking with us.

Overview of New Features

Robust and Responsive Mobile App

Intuitive Transaction Details

FinSights: Personal Finance Insights

Credit Sense & FinStrong

Account Connections & Notifications

Debit Card Controls

Frequently Asked Questions

-

Make sure your email address and contact info are up-to-date. Save copies of your eStatements. 18 months of eStatements will be available on the new system.

-

Your user ID will remain the same.

-

No. Your password will remain the same for your first login. However, once you have logged in for the first time, you will be prompted to create a new password. Your new password must be 9-32 characters and contain 3 of the following: uppercase letters, lowercase letters, numbers, and special characters.

-

No. Your bill pay payees and Zelle contacts will remain the same and any future/recurring payments will automatically carry over to the new system. Any payments scheduled before 3 PM PT on Thursday, 12/2/21 will automatically carry over to the new system. Bill pay will be unavailable after 3 PM PT on Thursday, 12/2/21 until Monday, 12/6/21 while we migrate systems.

-

No. Your existing external accounts will remain the same and any future/recurring external transfers will automatically carry over to the new system. Any payments scheduled before 3 PM PT on Thursday, 12/2/21 will automatically carry over to the new system. External Transfers will be unavailable after 3 PM PT on Thursday, 12/2/21 until Monday, 12/6/21 while we migrate systems.

-

Any recurring internal transfers, external transfers, bill payments, and Zelle payments will automatically carry over to the new system.

-

Any future-dated internal transfers, external transfers, bill payments, and Zelle payments will automatically carry over to the new system.

-

No; however, you will be required to update your FFB Mobile app on or after Monday, December 6 to retain access.

-

Yes. Challenge questions (also referred to as knowledge based questions) will no longer be utilized. If logging in from a new device or location, you will now be prompted to complete an Identity Verification challenge. An Identity Verification will consist of your choice of: a confirmation code delivered via text to a phone number on file, a confirmation code delivered via phone call to a phone number on file, or through out-of-wallet questions derived from public records.

-

No, you can now control your debit card alerts and settings directly from our Personal Online Banking and Mobile experiences.

-

Yes, you will have the statements you are used to seeing online today, but now they are also available through our mobile app, have expanded history, and now include other account notices and tax documents.

-

Yes, after moving to our new system you will need to set up any of the custom alerts you may have today. However, security alerts and notifications will still be active.

Mint, Quicken, and QuickBooks Information

Mint

Quicken

QuickBooks Online

QuickBooks Desktop

Need More Help?

- Call us 888-405-4332

- Chat with us. Select the link for “Chat” inside your online banking.

- Send us a Secure Message. Select the link for “Messages” under your name inside your online banking.