Providing financial clarity to our clients

What is Wealth Planning?

Wealth Planning is a client-centered process focused on developing a roadmap to help clients build, protect, and transition their wealth by looking at all areas of their financial life including retirement, tax, legacy, and business planning.

Our wealth planning services help clients piece together their financial puzzle to form the lifestyle picture they envision. We combine our experience and expertise with the latest financial tools to provide our clients clarity in all areas of their financial life.

Providing Our Clients Financial Clarity

Businesses

Individuals

Families

Our Wealth Planning Process - Your Path to Prosperity

We combine our experience and expertise with the latest financial tools to provide our clients clarity in all areas of their financial life. With a clearer picture of you, we can collaborate to develop a roadmap to achieve your goals.

Register for our upcoming webinars

Insightful content on a variety of topics including the financial markets, the economy, and personal finance.

More than Protecting and Preserving Wealth

Education and Resources

Client Portal

Online Vault

Helping maximize your wealth by minimizing your taxes

An effective strategy to maximize wealth includes combining comprehensive tax & wealth planning with tax-aware investing. We emphasize to our clients that it isn't what you earn that counts, but what you keep after taxes.

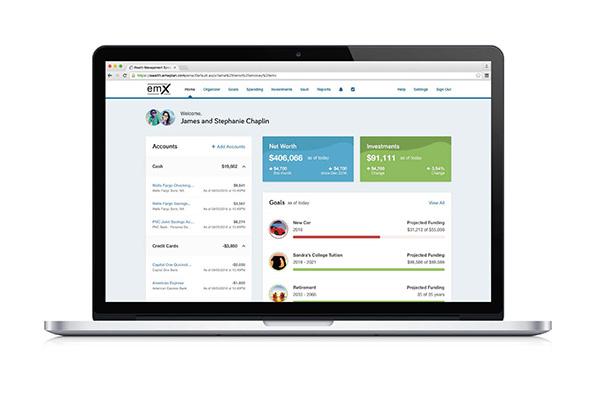

Leveraging leading edge technology to personalize the experience

We believe that the wealth planning experience should be driven by qualified professionals, not algorithms; yet we will still look to leverage technology to optimize the experience – and ultimately the outcomes – for our clients.

Wealth planning and investments go together

At first Foundation, we understand that successful wealth planning requires access to a robust set of investment solutions.